You may like to change your VAT settings for payments. These can be applied to preset payments as required.

How to Provide Your VAT Number #

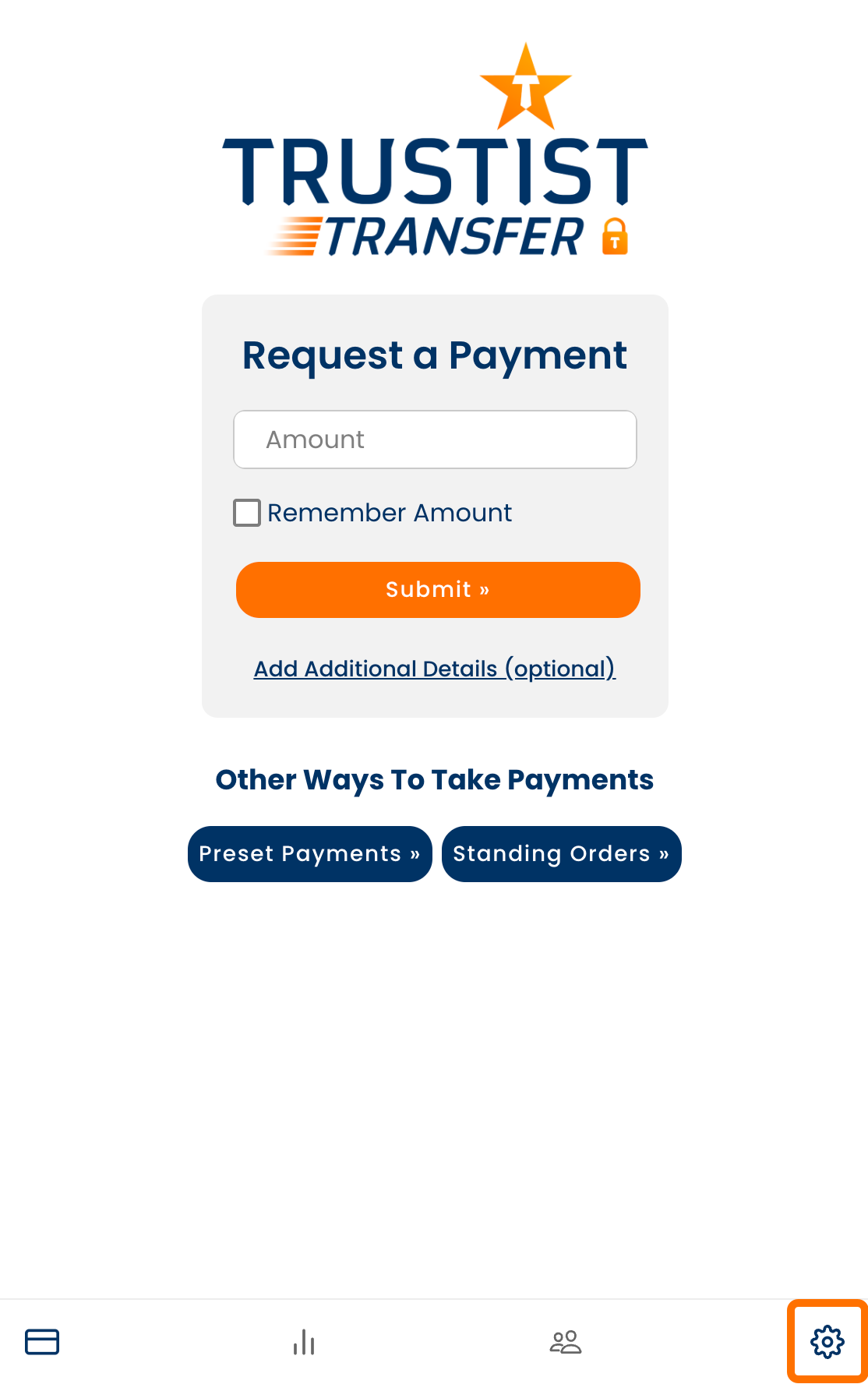

To get started, head to the home page of your TrustistTransfer account.

Click the settings cog at the bottom of your screen to bring up the settings menu.

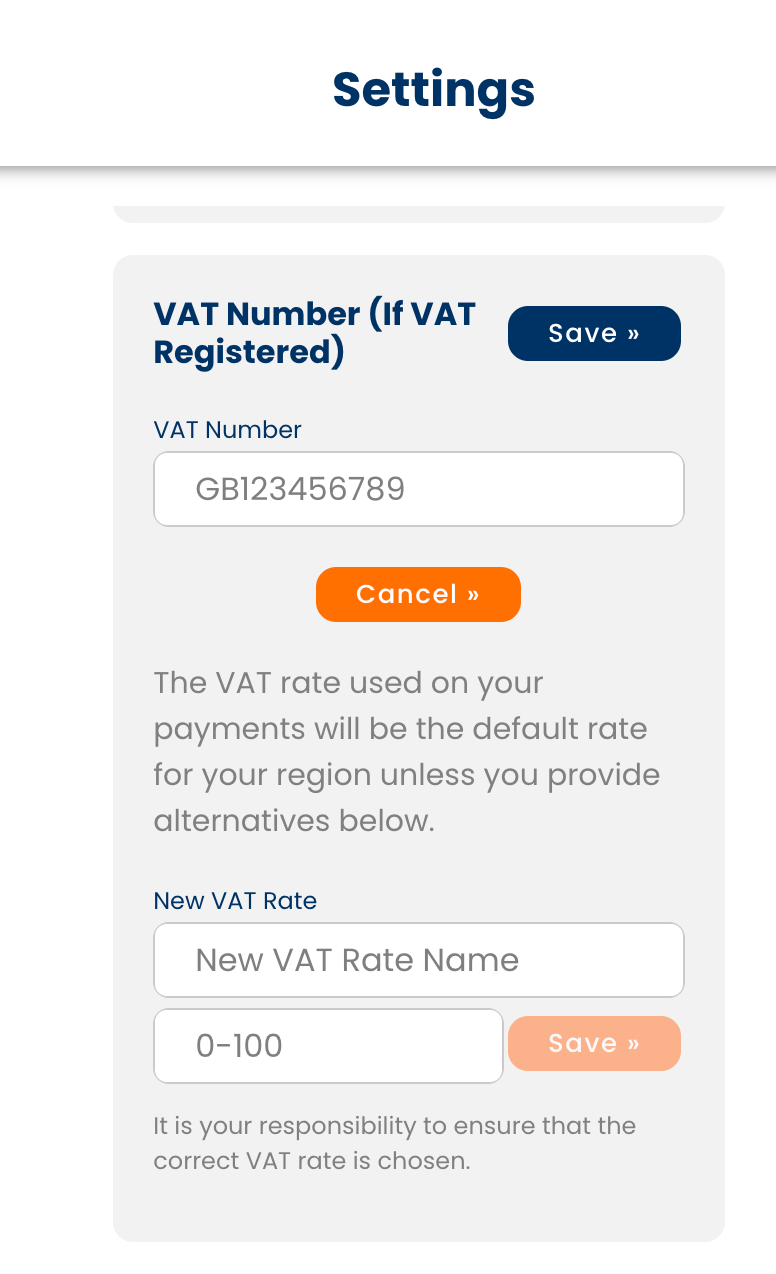

Scroll down in the settings menu until you reach the ‘VAT Number’ section.

Press ‘Edit »’.

Input your VAT number.

Press ‘Save »’.

How to Set New VAT Rates #

To get started, head to the home page of your TrustistTransfer account.

Click the settings cog at the bottom of your screen to bring up the settings menu.

Scroll down in the settings menu until you reach the ‘VAT Number’ section.

Press ‘Edit »’.

Once your VAT number has been added, you will then be able to set a new VAT rate.

You can name the VAT rate as needed. You should then input the VAT rate as 0-100, referring to the percentage rate of the VAT.

Press ‘Save »’.

Notes #

Note that it is your responsibility to ensure the correct VAT rate is in use.

The default VAT rate for your region will be the default for your payments unless an alternative is set up.